Pitch Deck Teardown: Metafuels $8M Climate Tech Seed Deck

Around 2% of global CO₂ emissions are caused by pressure sausages that fly through the air using jet propulsion. Earlier this week I talked about a startup called Metafuels that believes it has a solution to reducing aircraft emissions.

I was able to convince the company's founders to make me an offer for their $8 million seed round so I could dive deeper into the hardware used to raise funding.

We are looking for more unique decks to submit. So if you want to submit your own, here's how to do it.

Slips in this deck

Metafuels was kind enough to share his entire deck with TechCrunch+ for this analysis. There are some minor changes, but most of the slides are intact.

- cover

- Market size chips

- Product/technology slide

- Product manufacturing film

- Unit economy (large-scale production)

- Unique points of sale

- Technological roadmap

- Business model film (production)

- Cheap model chip (license)

- Marketing chips

- Slippery market traction

- Team slide

- Close the slide

Three things to love

If you've read my pitch deck teardowns, just a quick glance at the slide list above will have you saying, "Ugh, Haje won't be happy about this - there's a lot of information missing!" And yes, you'd be absolutely right. However, this is an interesting challenge for deep tech startups: if it takes a long time to bring your product to market, it will, by definition, miss out on a lot.

Is it a bird? Is it a plane? No, it's a big market

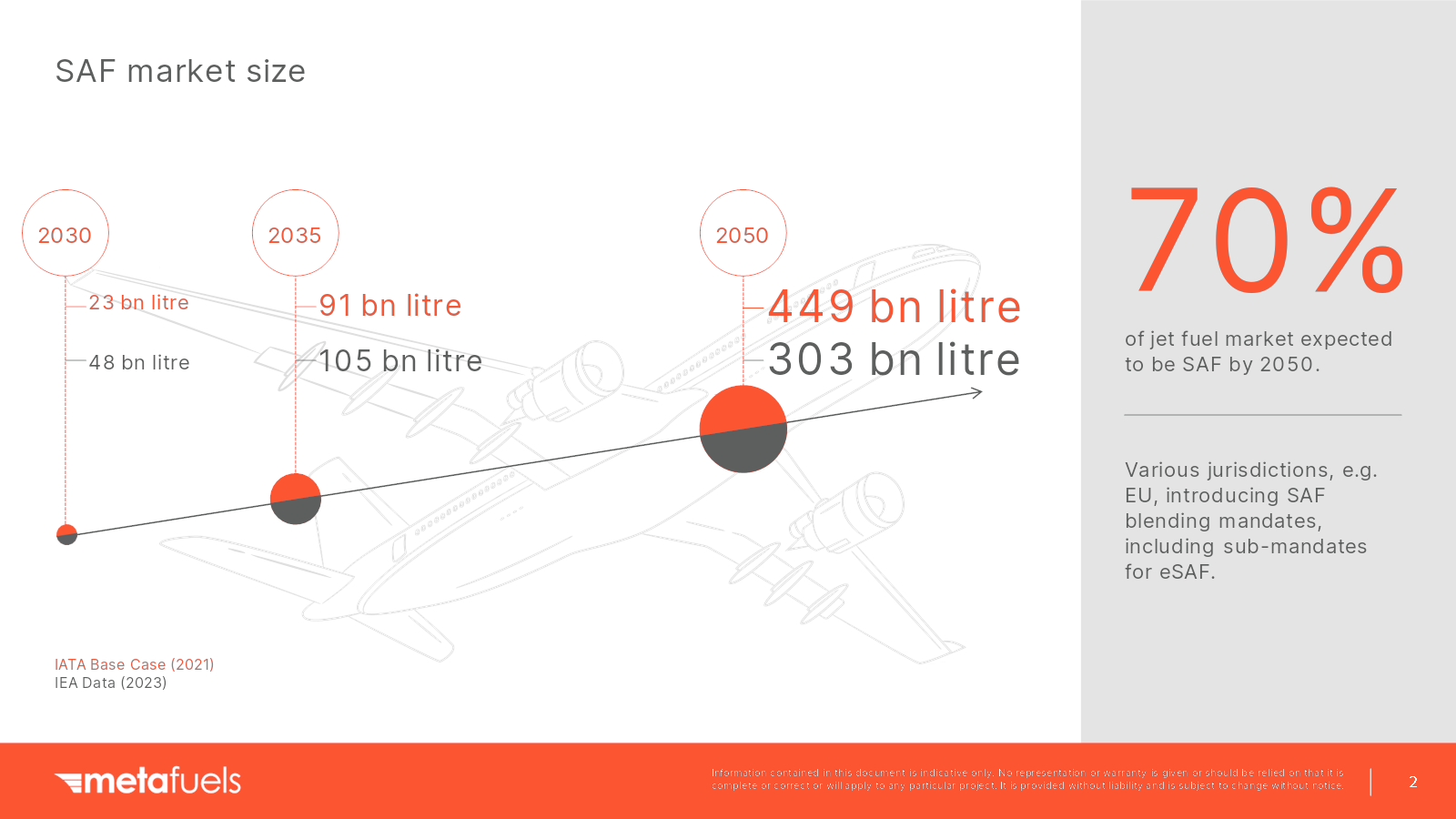

It takes a certain arrogance to say that "all kerosene" is your market, but that's what Metafuels is doing here.

[Slide 2] Targeting 70% of the jet fuel market is very bold. I like this. Photo credit: Metafuels

In other words, SAF accounts for approximately 0.17% of total aviation fuel consumption.

It is therefore not surprising that Metafuels has decided to start its forecasts from 2030. At this point, the company intends to ramp up production to full production and the market is expected to take off. The main feature of interest is the RefuelEU aviation regulation, which sets targets for blending sustainable fuels with their petroleum counterparts.

Metafuels tells the story well: we have the image of a fast-growing market and the company is positioning itself as a key player.

This slide will show you how to answer the question “Why now?” » Part of your story on broader macroeconomic changes. By knowing which way the wind is blowing, you can set up your campaign to make the most of it.

Let yourself become a tech nerd

When you build a deep tech company, the technology itself will always be the top pillar of the tent. What did you understand that no one else could?

[Slide 4] Ugh yeah, nerd, talk to me, honey. Photo credit: Metafuels

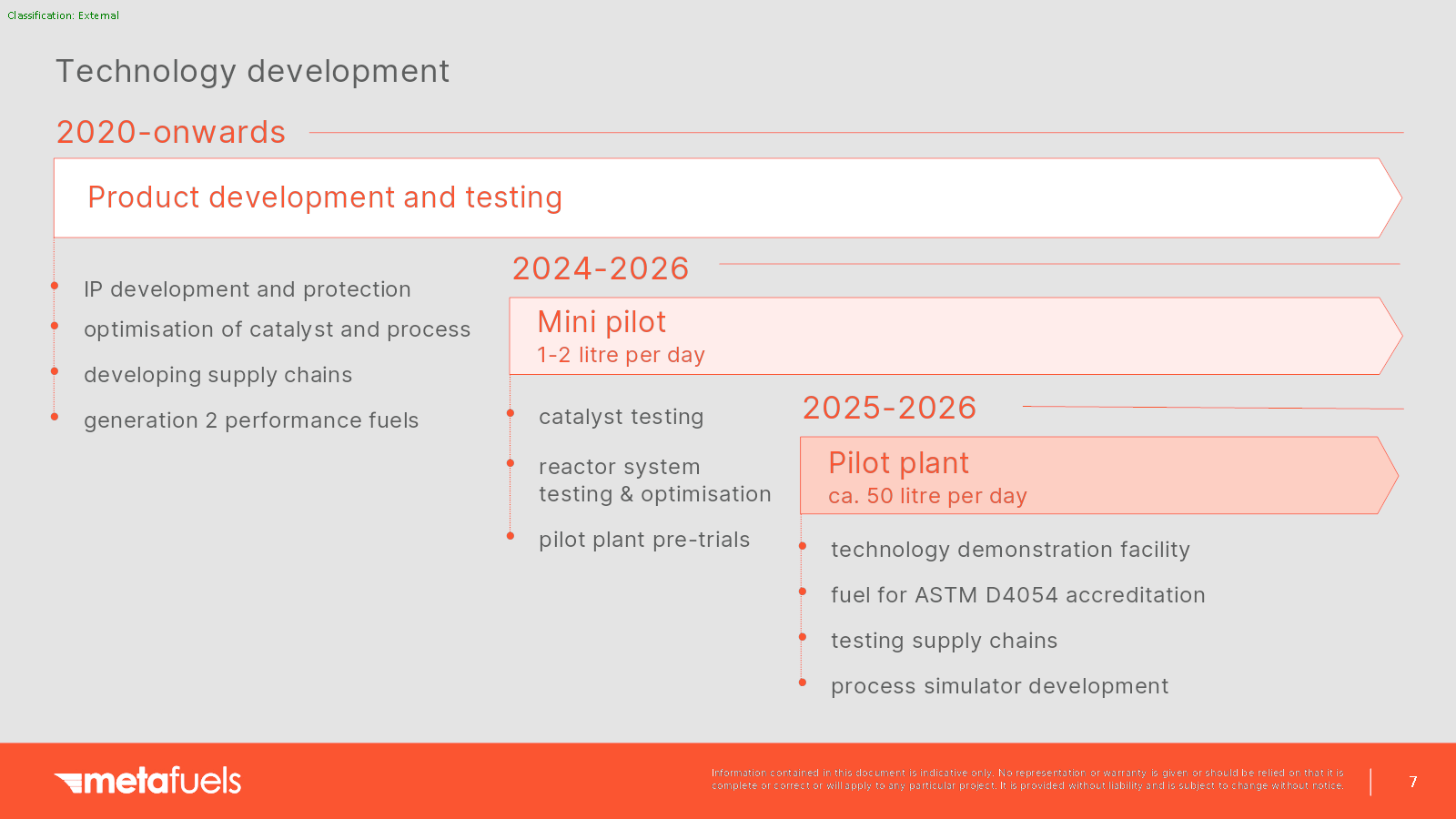

A clear roadmap

[Slide 7] I like the clarity of the Metafuels plan. Photo credit: Metafuels

The main goal of this part of the deck is to keep an eye on the future and adjust it later. A thorough understanding of unit economics in particular (i.e. how your product's financials change as you begin to scale) is often a crucial part of the story.

Here Metafuels is talking about producing 1-2 liters per day and then increasing this by 700 million. That is. . . damn thing. And while the manufacturing processes and factories to produce that amount of fuel will be expensive, the price per gallon will drop significantly. Metafuels solves this problem perfectly in this deck.

In the rest of this presentation, we'll look at three things Metafuels could have improved or done differently, as well as a complete deck!

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home