‘Ntype Will Be The Main Theme Of 2023: JinkoSolar Talks Tech Trends And Component Pricing

After shipping more than 44 gigawatts of photovoltaic panels last year, Chinese manufacturer Jinkosolar expects that number to increase by 50% by 2023.

PV Tech spoke with Jinkosolar Vice President Danny Qiang about module pricing, Topcon's outlook, and key corporate goals for this year.

Did the company meet its target of shipping 43.5 GW of modules last year? What market is the company targeting to supply modules?

Danny Qian : Yes, we have exceeded the target by delivering 44 GW+. As for the main target markets, these are China, Europe, Latin America and Asia.

Can you share some delivery times for the Tiger Neo module once the series is launched in November 2021? How has the product been accepted by the industry?

By the end of 2022, we have deployed 10 GW Tiger Neo in more than 80 countries. Tiger Neo is very popular with customers, especially because of the power source, which is so important to them.

Zincosolar recently announced the release of the second generation of its Tiger Neo module. How much has the series improved over the first generation?

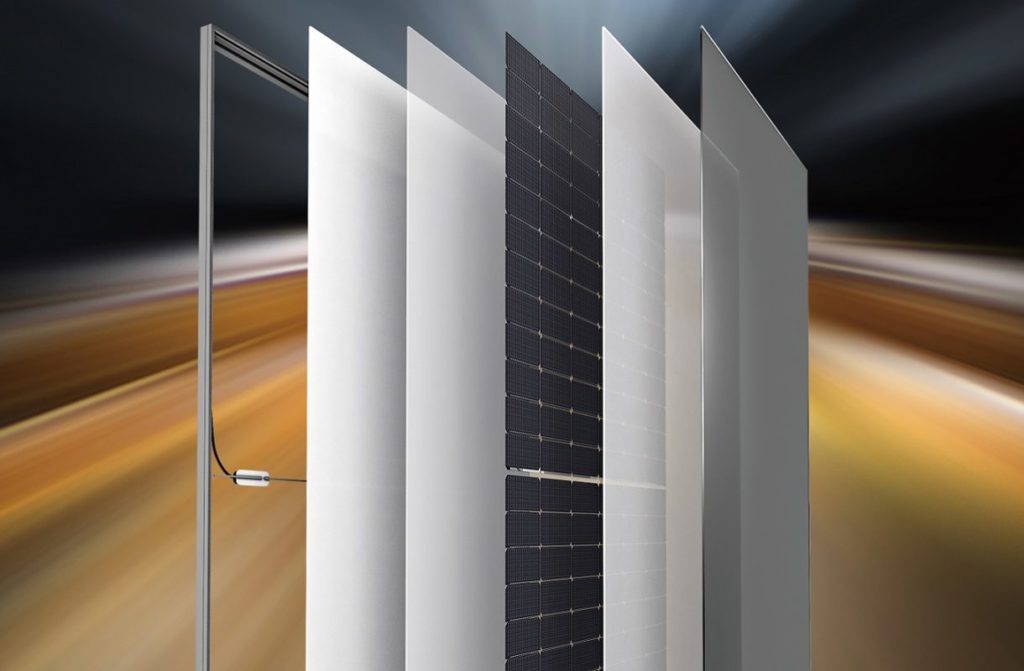

Tiger Neo is a revolutionary N-type panel with a 23.23% time to market. Compared with the first generation, the average efficiency is 1% higher, and the output power is 15-20 W higher with the same volume. The temperature drops from -0.30% to -0.29% and the bidirectionality increases to 80%±5%.

What are the business benefits of using Topcon modules?

We are seeing a shift in the consumer solar PV business to N-type. Since the solar industry is very competitive and responding well to better and more affordable technologies, the main theme of this year's Solar Photovoltaic Show will definitely be N-Type. Module manufacturers know that if they don't change, their competitors will. That is why we are moving forward and leading the industry in this direction.

Over the past four or five years, despite the company's claims, the photovoltaic industry has not introduced any new products; It may be big, but it's nothing new. This is the new N-type Topcon, which has more power (W) and increased efficiency (kWh/kW).

The focus on Type N confirms our leadership in technological innovation and manufacturing excellence. This enhances our competitiveness and contributes to our balance sheet. Solar energy is a capital intensive industry and Topcon's capital efficiency is high. This has led to innovation in the supply chain, from equipment to material handling, resulting in an integrated ecosystem.

What production capacity does the company expect by the end of 2023? What challenges will you have to overcome to achieve this goal?

A 50% increase by 2022 is a conservative forecast. Volatile polysilicon prices, an unpredictable new supply chain, and US dollar volatility against the Chinese yuan have all had an impact, but as Tiger Neo ramps up competitive pressure, n-Topcon remains a major challenge in the industry.

What are the company's other big goals for 2023?

Energy accumulators, residential, instrumentation, utility and BIPV systems, both on the roof and on the facade.

The cost of polysilicon has fallen. What is the price potential of the module this year?

The recent decline in polysilicon prices is mainly due to the sudden and simultaneous release of new capacity built by several large polysilicon companies two years ago, but problems remain due to high polysilicon inventories held by wafer manufacturers in response to shortages. Last two years

However, when these supplies return to normal and no new capacity is added, the balance will be restored and polysilicon prices will again stabilize around 100-130 yuan/kg (14.80-19.20 USD/kg), otherwise polysilicon suppliers will be cut off. . capacity and production. Indeed, current wafer capacities still contain very high amounts of polysilicon. New problems in wafer manufacturing have driven polysilicon prices down, but this is reflected in the forecast and will be less noticeable on the module side as new bottlenecks and disruptions occur in the supply chain – just like polysilicon prices rose 400%. A few years ago, module prices rose by only 20%.

The best solar panels? - Tesla Panel vs Ginko Solar Panel

posted by Admin @ February 07, 2023

0 Comments

![]()

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home