Pitch Deck Teardown: Phospholutions $10M Series A Extension Deck

I haven't seen many agtech startups apply for this series, so I was thrilled to receive one from Phospholutions, which just closed a $10 million round, bringing its funding to $32 million.

The team initially said they would use the bat to lift a Serie B round, which confused me, but after reading the press release more carefully, it appears they were wrong. Normally I would let people get away with things like that, but this deck is full of problems that could have been avoided with more attention to detail.

We're looking for more unique billboards to remove, so if you'd like to submit your own, here's how.

Slides from this series

Parts of the Phospholutions series are heavily edited, so it's hard to get the full picture, but there's still a lot to say.

- Slide the cover

- Problem slide

- Market context slide

- Business opportunities are disappearing

- Slide solution

- Benefits slide

- Slide the product

- Scroll to see the benefits of sustainability

- Competition slides

- Value proposition slide

- Competitive price comparison slide

- Slide Margins (Editorial)

- Go to the market slide

- Funding history slide

- Short-Term Goals Slide (Editorial)

- 5-year forecast (true)

- Use of Series B proceeds (not included)

- Group slide

- Investors are currently reeling

- Summary slide

- close the slides

Three things to love

The Phospholutions Pitch Deck is a compelling demonstration of innovation and strategic vision that embodies the essence of effective promotions. It's a harmonious combination of a compelling story, a clear value proposition and compelling data that together create a compelling story.

AP or not P?

[2. Difference] Clarity through the door. Image credit : phospholution

Investors familiar with agricultural technology probably know this well. The market has several players who have performed well over the years, and if Phospholutions has an innovative approach to the problem it is certainly an investment that says yes.

I like the simplicity of the graphics. I was pleased that the company mentioned the impact of the problems ("reduced farmer profits" and "inefficient use is harming our waterways") as well as mentioning the problems themselves. All good story points.

As a result, “farmers need more reliable solutions. . "He proposed a solutions-oriented approach and explained what needed to be done. Taking this as a promotion, it became clear what happened next.

There's a lot of information on this slide, but I like how each point logically leads to the next, creating a narrative flow that helps direct the eye and encourages the reader to stay interested. It's also scannable so you can absorb the content quickly. Very bright

Some chatter. I know P is phosphorus, but the writer in me keeps stumbling upon inexplicable acronyms. Also, there will be no shortage of space on this slide, so obviously , even though GHG is short for greenhouse gases, you can still write. And “~1.7MT CO2 eq/MT P 2 O 5 ” is a lot of alphabet soup to throw into an opening slide.

Now I get off my soapbox, but attention to detail is key.

Contextualise the short and medium term prospects

I rarely see startups do something like this, which is a shame because it helps shape the story really well;

[3. slide] “What happens if we don't solve this problem?” Image credit : phospholution

By grouping content into “Today,” “Short Term,” and “Long Term” categories, readers can understand how market dynamics will change over time. The story is good, but it also has the more important benefit of showing that its creators are looking to the future and sticking to their guns rather than where the punch is. Investors like to see that founders are looking to the future.

Another victory in the story here is not clearly indicated on this slide, but it sets the stage for the action. obviously, the action offered by Phospholutions.

Real impact

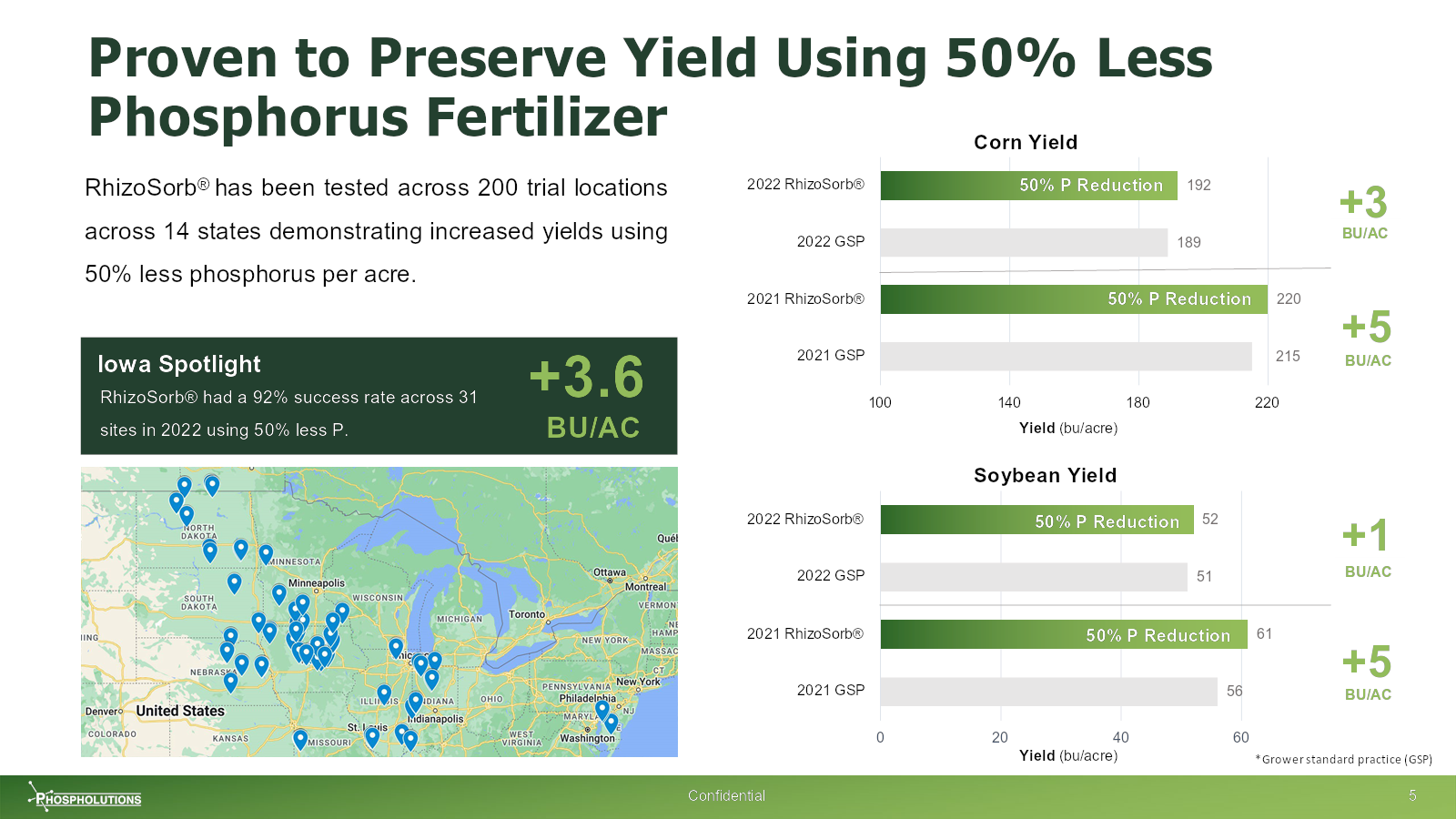

I think Mantra spends too much time on the product. But the other side of the coin is that it does a lot of things very well. This slide, in particular, does a lot of heavy lifting.

[7. slide] Protected data. Sweet. Image credit : phospholution

What I like about this set of slides is that it explores its proven effectiveness. If the investor asks for more information, there is plenty .

In the rest of this analysis, we'll look at three things that Phospholutions can improve or do differently, as well as the deck as a whole.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home