Pitch Deck Teardown: Transcends $20M Series B Deck

Whether you're planning a large infrastructure project like building a new city neighborhood or determining how much water and wastewater is needed in a certain area, you've probably run into problems. . . “But modeling and planning,” I hear you cry. “Aren't computers designed to be good?”

Well, yes: so it's no surprise that Transcend raised a $20 million Series B round from Autodesk and others.

It's a new world of design that I don't really know. But $20 million doesn't lie, so let's see where Transcend goes and where it ends up.

We need more unique tones to stand out, so if you'd like to submit your own, here's how.

This floor is slippery

The Transcend team has shared the deck with us in a slightly modified form. I'm not usually a big fan of this, but the team included as many decks as possible with only minor changes. The changes are as follows.

- Slide 11: Self-supply chain data points

- Slide 13: Product Roadmap and Financial Forecast by Vertical

- Slide 14: Customer Name, Project Name, Revenue Number and Sales Date in case of OEM services

- Slide 16: Financial goals, including net income maintenance projections, CARR projections, ARR projections, cash margin projections, and total net worth projections.

Aside from the above, the deck is pretty much the same, so you should still get an idea of how the company's story plays out. This is a complete classification of deck slides.

- Cover slide

- Summary slide

- Problem and solution slide

- Product slide

- Gravity slides

- Advantage slides

- Virtual presentation slides (video)

- Company/product history

- Flexible slide

- Drag the guest room

- Drag the value proposition for each customer segment

- Enter the market opportunity

- Product roadmap slide

- Customer case study slides

- Group slides

- Use the money slider

- Closing the slide

I like three things

There are many great examples of Transcend decks. My top three.

You don't just turn a child over

It's not uncommon for a startup to abandon another business, but explaining how and why this happened can be tricky. But Transcend does this particularly well;

[8 page slides] Success overnight, 10 years later. Image credit . Cross

Very well done!

Same tool, different benefits

Tools can be used for all sorts of things; That's the beauty of the tool, but it's hard to explain how different audiences can find value in different use cases.

[Slide on page 11] The design gives me a headache, but the information conveyed is excellent. Image credit . Cross

But be careful. Having multiple customer segments is good, but it's easy to feel unclear at first. Selling to schools is different from selling to hospitals or governments, and each often requires different sales methods. In that case, let me get away with it; The number of organizations needing large-scale infrastructure design may be limited, so explaining how a company can sell multiple verticals at once helps tell the logic of the “hey, market size is perfect” story.

Relative market size

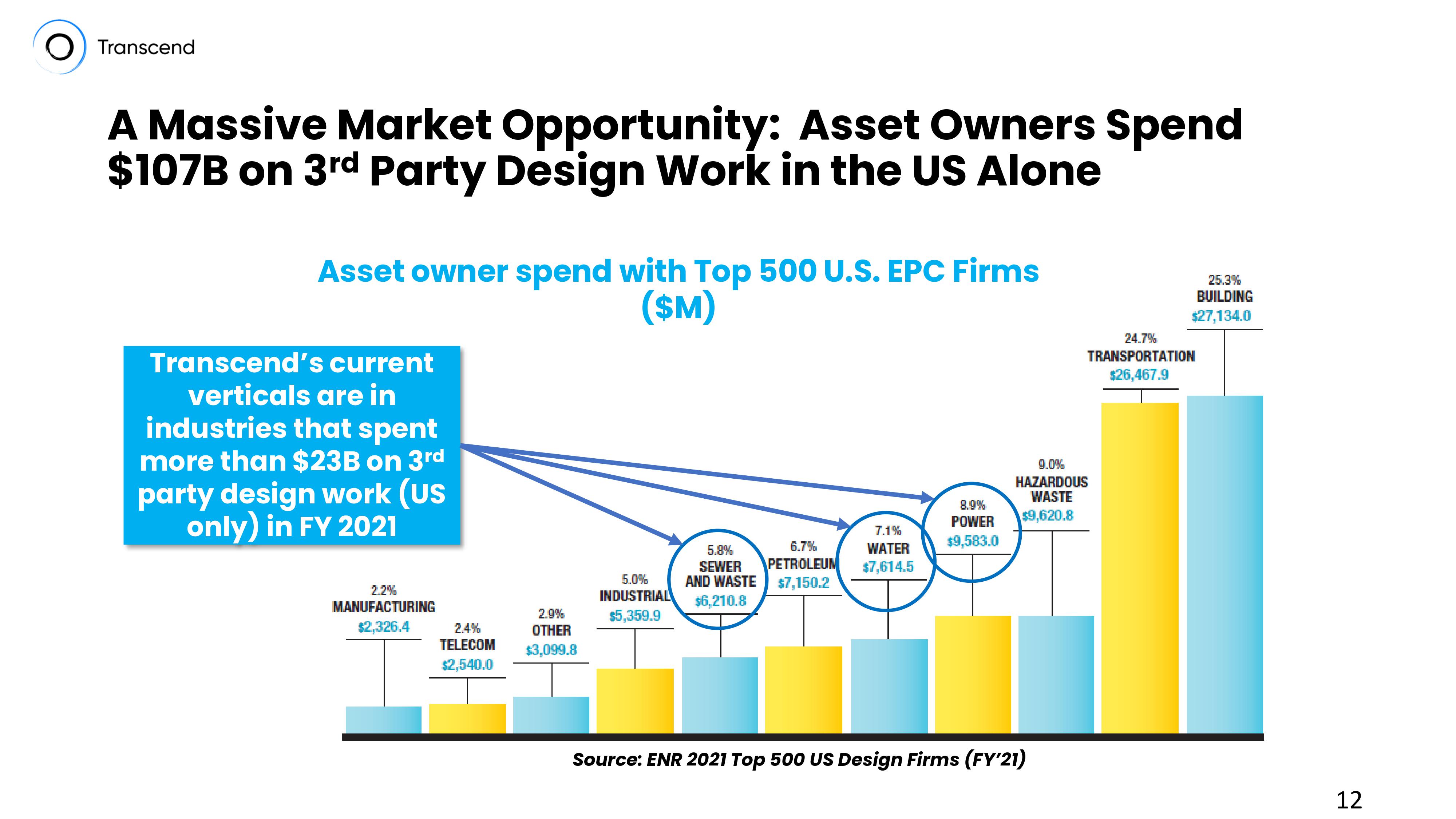

[Slide 12] Hi, market size. Image credit . Cross

Graphic and information design aside, I like how this slide clearly shows the scope of the opportunity today and how much it can grow if the company adds more verticals to its priority list. I don't know the industry well enough to see if $100 billion in R&D is a number that Transcend can realistically track (in other words, Transcend would make $100 billion a year if it had total market share) (this seems a little ambitious ). But I don't know how to test it). Perhaps investors working in this industry will immediately recognize this as true.

As a startup, remember what you can learn here: Vertical expansion can offer huge opportunities. Draw a picture if it fits your organization. This helps show the extent of your and ultimately potential investors' interest.

In the rest of this list we'll look at three things Transcend could have improved or done differently, beyond the overall sound.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home