Pitch Deck Teardown: Xytes $30M Series A Deck

When I was a student in the UK , I remember that renting appliances such as washing machines and TVs was common for some people, especially short-term students. Israeli startup Xyte (pronounced "accent") just raised $30 million in what it says will be a return to the hardware-as-a-service model for manufacturers whose bottom lines are under constant pressure. If software-as-a-service works so well, why not hardware?

Xyte let me watch his 27-slide presentation on how he did it. Was I excited about the Xyte deck? Unfortunately, no. This 27 slide presentation did not have the information I needed as an investor to decide whether or not to invest. Look what I saw.

We're looking for great content to share, so if you'd like to submit yours, here's how.

This series of slides

Xyte's table consists of 27 slides, some of which contain redacted information. Newsrooms focus on customers and business performance, which is fair enough, but at the same time it's a bit more difficult to get an overview of the company as a whole.

- Sliding cover

- Company overview with team information

- Group slides

- Alternative slides

- Ability to create 2 slides

- market slides

- Push the issue

- Promote the value proposition

- Pass through the solution

- Slide 2 solution

- Slide 3 solution

- Dedicated slide interface

- Traction slide

- Slide "Any sector, any size" (client base)

- Promote the value proposition

- Business Transformation Slide.

- Slide "Platform for business and commerce"

- Customer research slides

- Slide "Introducing a new product category"

- "One Integrated Platform" slide.

- Group slide 2

- Intermediate slide

- Slide business model

- Slide "Entering the market".

- Slide "Forecasts and Drivers"

- Presentation slides about investments

- The last slide

Three , two things to love

With 27 slides, you'd think there would be plenty to choose from in the Three Good Things category Dear Reader, I'm not going to lie, try as I might, I had a really hard time finding three good things in this deck.

So let's talk about two bright sparks I noticed in this inky void of despair:

Introduction Summary

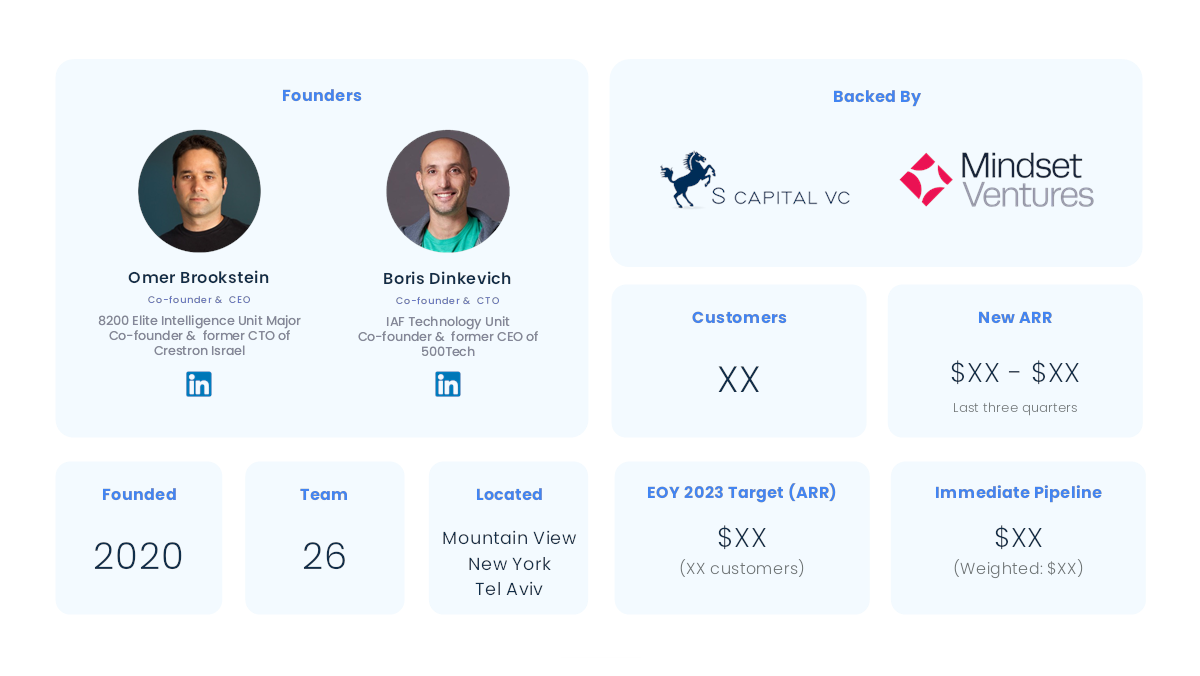

[2. Slide] A very well done slide. Image Credit : Xyte

While some of the key figures have been revised, at a glance they reveal many important facts that investors can pay attention to. In fact, I think this slide will be my go-to template for raising money for most startups: it's clear, to the point, and helps set the stage for what's to come.

Put everything together

I have a lot of respect for CV and this play has succeeded not once but twice The first sets the scene and the second (below) is a retelling of the same story but from an investor's perspective.

[26. slide] is a short summary that covers everything. Image Credit : Xyte

- Big Chance: Yes! A startup must reach the "venture capital ladder" to become eligible for investment. Investors should be reminded here of the true size of the market, but this slightly more abstract summary works well.

- The only solution is yes! It's great to include a reminder of what you're actually doing.

- World class products. Honestly, I wish I could back this point up with data. Is it a world-class product? Maybe, but bring the receipt!

- Proven Solutions: Sure, but don't forget to include the reason. What supports this conclusion? I suspect that what the company is trying to convey here has to do with the following point. . .

- GTM's Scalability Strategy. The ability to get customers at scale is what makes a startup stop being a startup, and that's a good thing. For bonus points, I remind investors about the CAC:LTV ratio, but it's a good start.

- Drishti: Hmm. It's not a reminder of the company's vision, it's a missed opportunity. Maybe write a summary of the team to remind investors why this is the right team to start a business with.

Minor tweaks aside, I think this Investment Summary slide did a great job and I'm glad the team decided to include it.

In the rest of this presentation, we'll go over three things Xyte could improve or do differently, plus a full presentation!

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home